Snapshot

- There is a case to be made for the government to help out the incumbents so that they don’t go under.No one gains by bleeding the industry so much where one more player considers exiting the field.

One of the first decisions any government formed after the general elections will be up against is the auctioning of 5G spectrum. The Telecom Regulatory Authority of India (TRAI) has announced a base price of Rs 4.9 lakh crore for a total of 8,644 Mhz of spectrum on offer at a time when the industry is bleeding profusely from the sharp tariff cuts offered by Reliance Jio since September 2016. According to Telecom Secretary Aruna Sundararajan, the auction timeline remains mid-2019.

In the December 2018 quarter, newly-merged Vodafone Idea reported a massive loss of Rs 5,005 crore, which came on top of a loss of a similar magnitude in the previous quarter.

Airtel posted a surprise profit of Rs 86 crore in Q3, helped by a rise in data revenues and customer additions, but in the bruising competition that still lies ahead, one cannot be sure these profit figures will hold, especially if both Airtel and Vodafone Idea have to invest heavily in network infrastructure to roll out 4G VoLTE services all over the country. High prices for 5G spectrum could just break their backs.

Both Airtel and Vodafone Idea are asking for a delay in the 5G auction, since they cannot afford to sink even more resources to buy spectrum right now.

Two things are worth noting.

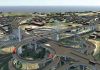

First, delaying the 5G spectrum auction means India will fall behind in the global rollout of these high-speed services. China began planning for 5G services as far back as 2013 in order to lead the next wireless revolution. The US began rolling out 5G services towards the end of calendar 2018, and Europe, Japan and other countries will do so this year. Ericsson Mobility estimates that by 2024, some 1.5 billion people will be on 5G networks. The biggest benefit of 5G is superfast downloads, with speeds of 100 Mbps, currently available only on fibre networks, made possible on wireless handphones.

India cannot wait another year to auction spectrum for 5G, and then hope that the services will be rolled out a year later.

So, the logical way out is for the government to get the auction going by June 2019, lower base prices, and backload the bulk of the bid payments over the 20-year term of the spectrum bought. This way cash outflows will be minimised in the initial years, and accelerate only after the traffic and demand grows after tariffs stabilise. Another possibility is to allow 5G bids to be a mix of cash and revenue shares.

Second, the Vodafone CEO is partly right when he says that some regulatory decisions benefited Jio in the last two years, especially the decision to cut interconnect charges from October 2017, and eliminating it altogether by 2020. But this charge would have gone sooner or later, and so this is an overblown complaint. The real reason why the incumbents are losing money hand-over-fist is that they had underinvested in network and data services when they had the market to themselves. They also harvested profits in advance of a decent network rollout. This delay is what cost them a serious loss of market share when Jio entered the picture. Any junior management student could have guessed years in advance that Jio will seek market share by cutting tariffs to the bone and shifting the focus to data from voice.

However, there is a case to be made for the government to help out the incumbents so that they don’t go under. No one gains by bleeding the industry so much where one more player considers exiting the field.