It has been alleged that IOC which was earlier importing LPG through the government-run Visakhapatnam Port was instead being made to use APSEZ’s Gangavaram Port, under an ‘unfavourable’ take-or-pay contract.

Context: State-owned Indian Oil Corporation (IOC) was under attack last week from the Congress and TMC.

The attack came in light of IOC signing an initial pact with Adani Ports for using the Gangavaram Port for importing liquefied petroleum gas (LPG), giving it preference over the Visakhapatnam Port.

Swarajya explains what is the controversy surrounding the public sector giant.

What has Mahua Moitra claimed?

Mahua Moitra who is a Trinamool Congress (TMC) Member of Parliament alleged a “scam” in hiring of the port facility without a tender.

On 15 February, she tweeted the screengrab of a news report based on the investor presentation of the Adani Ports and Special Economic Zone Limited (APSEZ), in which the company had said, “MoU signed with IOCL for a take-or-pay contract at Gangavaram Port for building LPG handling facilities”.

What are the Congress party’s allegations on Adani and IOC?

Soon after, the Congress party on 17 February alleged that IOC was “being made to” import LPG from APSEZ’s Gangavaram Port, under an “unfavourable” take-or-pay contract.

“Now we learn that IOC, which was earlier importing LPG via the government-run Visakhapatnam Port, is instead being made to use the neighbouring Gangavaram Port and that too via an unfavourable ‘take-or-pay’ contract. Do you view India’s public sector simply as a tool to enrich your cronies? “, said a statement addressed to Prime Minister Narendra Modi, issued by Jairam Ramesh.

What has been the IOC’s response on the matter?

IOC in an unusual move sent out a series of tweets on 16 February to clarify its position.

The public sector giant in its reply stated that it had only inked a non-binding MoU with APSEZ, and there was no take-or-pay liability or any binding agreement “as of now”, which is being seen as a rejection by IOC of Adani Ports and SEZ’s claim.

“IOC has just signed a non-binding MoU with APSEZ till now ” it said, adding that “there is no take or pay liability or any binding agreement, as of now”.

Further, IOC stated that oil marketing companies (OMCs) do not invite separate tenders for hiring LPG import terminals, and instead take a call based on their evaluation of the facility’s infrastructure “for its suitability for catering to the nearest market at a reasonable cost”.

What is ‘take-or-pay’ contract?

Take-or-pay provisions are now fairly common in long-term offtake and supply agreements in the energy sector, a notable example being gas supply agreements.

In essence, take-or-pay provisions provide that a buyer must pay for specified quantities of energy (gas, for example) from a seller, even if the buyer is unwilling or unable to take such quantities.

At the most basic level, take-or-pay clauses require the buyer either to purchase and take delivery of certain quantities of gas, or to pay for the gas regardless of whether it takes delivery.

How IOC currently imports LPG?

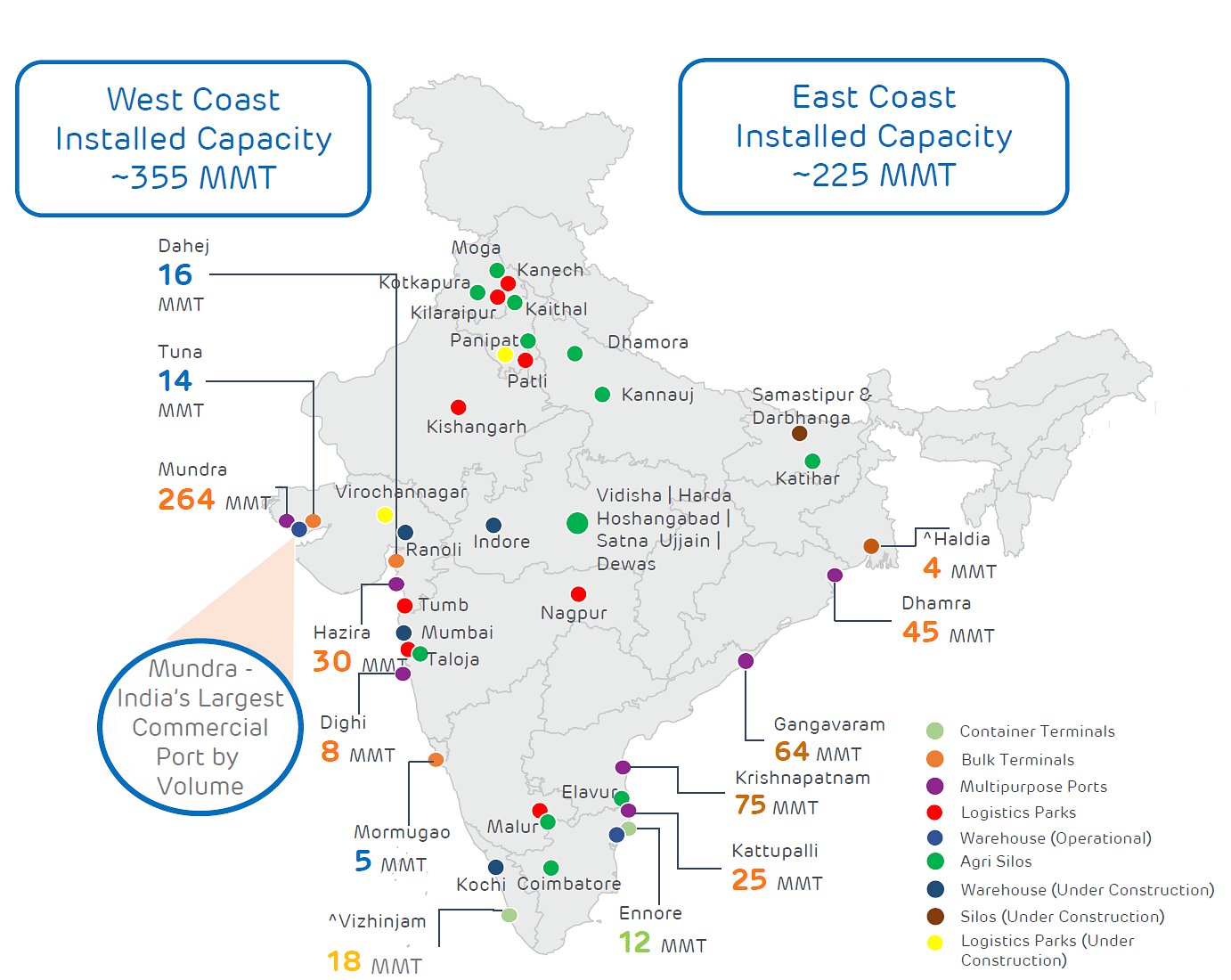

Replying to Moitra’s tweet, IOC said it imports LPG at various ports, including BD Kandla, Mundra, Pipavav, Dahej (in Gujarat), Mumbai and Mangalore (in Karnataka) on West Coast and Haldia (in West Bengal), Vizag (in Andhra Pradesh) and Ennore (in Tamil Nadu) on the East.

Two more import terminals are coming up at Kochi in Kerala and Paradip in Odisha, which will be used in due course of time, IOC said.

The company in its reply said that LPG demand in India is rising rapidly, suggesting that LPG imports are expected to rise over the next few years. Therefore, OMCs are “constantly on the lookout” for new ports that make commercial sense, it said.

What is IOC rationale behind signing an initial pact with Adani Ports for Gangavaram Port?

Sharing details about the terminal hiring pacts on the east coast, the company said currently there are only two terminals near Vizag.

These are South Asia LPG (SALPG) – a joint venture of France’s TotalEnergies and HPCL and East India Petroleum Limited (EIPL) which is a private company.

“SALPG charges Rs 1,050 and EIPL charges Rs 900 as charges with lower capacity vessel unloading capability. EIPL facility has no captive connectivity to be used on continuous basis.,” IOC said.

Compared to this, APSEL has offered a price of Rs 1,050 for LPG import terminaling charges with facility of unloading of bigger vessels of refrigerated LPG directly, it added.

IOC said that the Gangavaram port will give an additional advantage compared to SALPG and EIPL as bigger vessels can be quickly unloaded. Such an arrangement will save freight and demurrage due to extra time for evacuation.

What will be the status of Visakhapatnam Port moving forward?

The Company rejected the claim that it was moving business away from government-owned Visakhapatnam Port, saying that port will “continue to be utilized, based on commercials”.

While IOC imports through Vizag Port is about 0.7 metric tonnes per annum (MMTPA) of LPG, the proposed number for the new Port at Gangavaram is 0.3 MMTPA of LPG.

Availability of multiple import terminals at Vizag and Gangavaram will give operational flexibility, increase competition among terminal operators and also create opportunity of getting competitive rates, it added.